Centric Bank Institutes Comprehensive COVID-19 Response to Support Businesses, Employees, and Communities

By Centric Bank

By Centric Bank

Centric Bank has taken specific comprehensive actions to respond to COVID-19 and support businesses, employees, customers, and communities.

“The health and safety of our employees, customers, businesses, and the community are priority one for us at Centric Bank,” said President and CEO Patricia A. (Patti) Husic. “As an essential business, we immediately enacted our business continuity plan in response to COVID-19 and are doing everything possible to slow the virus spread and help save lives. Our goal is to keep our employees and customers safe while providing critical resources and assistance to help our small business customers. In this new normal of social distance banking, we temporarily closed our lobbies and walk-in access, but we are always available by phone, FaceTime, Zoom, social media, online banking, drive-thru, and mobile banking.”

To provide customers with uninterrupted access to banking services during Gov. Tom Wolf’s Stay at Home order, Centric Bank has launched a comprehensive customer-first plan to help communities stay #StrongerTogether during these unprecedented times.

- We are reaching out with personal calls to all of our business customers who bank in our financial centers, informing them about safe, convenient banking options such as mobile banking and night drop depositories. We arranged for customers to easily use remote deposit capture and assisted in online and mobile banking service setups, as well as telephone banking services and ATMs.

- We have closed all financial center lobbies to transactions and walk-in banking until further notice. We have offered private concierge appointments with customers for transactions that cannot be accomplished at a drive-thru, and our team will observe social distancing during these meetings. Drive-thru facilities are still available to our customers to accommodate all transactions with hours and addresses listed here. To support our customers, we will extend our hours of operation at drive-thru locations if the transaction volume warrants the extension.

- We have offered interest-only payments or loan deferments on a case-by-case basis and have assigned lenders to be on-call to help clients navigate unprecedented financial challenges.

- For our existing consumer customers, we have offered a skip-a-payment program as well as a consumer lending product to assist in these uncharted waters.

- A remote work plan was launched for the majority of our employees, and we have rotated our senior leadership to ensure a member of the leadership team is on premise in our operational location.

- We continue to monitor the CDC and PA Department of Health guidelines and have educated all employees on COVID-19 health and safety precautions.

- We have increased the number of visits each week from our cleaning companies and enhanced cleaning and sanitization protocols during these times. We have also displayed social distancing signage, as well as provided gloves and sanitizers at all our locations.

- To ensure our employees are entering and working in a clean, safe work environment, we have professionally sanitized and disinfected all bank locations.

As a leader in SBA lending, we are also encouraging eligible businesses to apply for the U.S. Small Business Administration (SBA) Economic Injury Disaster Loan Program (EIDL), as well as assisting our current SBA 7(a) customers with guidance on 6 months’ payment forgiveness by the SBA.

In response to the CARES Act established March 27, 2020, we are processing Paycheck Protection Program “PPP” loans for our small business customers, as well as helping non-customers who apply in the communities we serve. Our experienced team members are working diligently to process these requests. To date, we have processed more than 800 applications totaling over $120 million in small business PPP loans, and our first wave of applicants has received funding.

To provide a lifeline for our small business community, we are working with current small business customers and commercial real estate owners who have been impacted by COVID-19 to provide interest-only loans and, in select cases, 90 days of full principal and interest deferments. To date,

$102 million of our commercial loans have full principal and interest deferments, and an additional $92 million are modified with interest-only payments. These same customers have also applied for the PPP SBA loan program.

2019 Annual Shareholders Meeting Changed to a Virtual Meeting

Gov. Tom Wolf has mandated the Commonwealth of Pennsylvania to observe a Stay at Home order until April 30, 2020, due to the COVID-19 outbreak. We are uncertain as to when this order may be lifted. In the meantime, our goal is to provide a safe, interactive Shareholders Meeting on May 21, 2020, at 10 AM, and we will be announcing access to virtual methods of attendance. We encourage Shareholders to vote their shares either online or by phone as further described on the proxy ballot card, which is now being distributed.

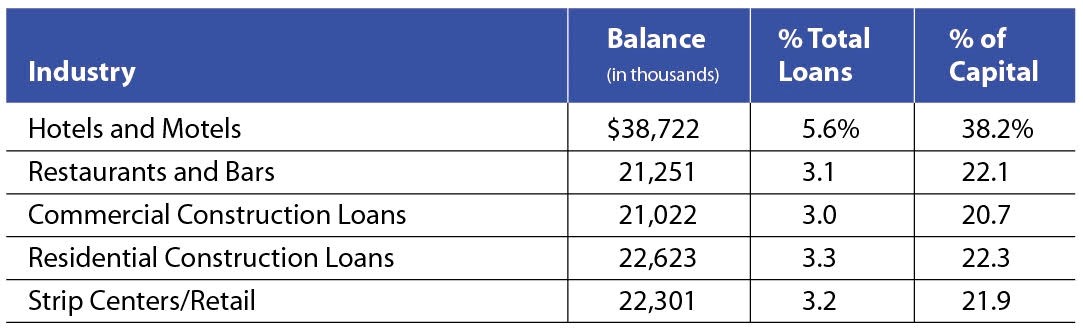

Portfolio Concentration

In response to investor inquiries and to assure Shareholders of our diversification, the chart below is a summary of select loan concentrations as a percentage of total loans and regulatory capital as of March 31, 2020:

[lp-contribute]

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)