John Bogle’s Investment Wisdom: “It’s The Fees, Stupid”

Forbes annual investment guide published on June 30th gathered the investment wisdom of twenty of the finest market minds – dead or alive, according to the magazine, distilling each person’s wisdom into specific recommendations about which stocks, bonds, funds and securities investors today should buy and when they should buy them.

Forbes’ group of 20 included five billionaires (including Warren Buffett, Carl Icahn and Sam Zell), a miser (Hetty Green) and one of the nation’s Founding Fathers (Alexander Hamilton).

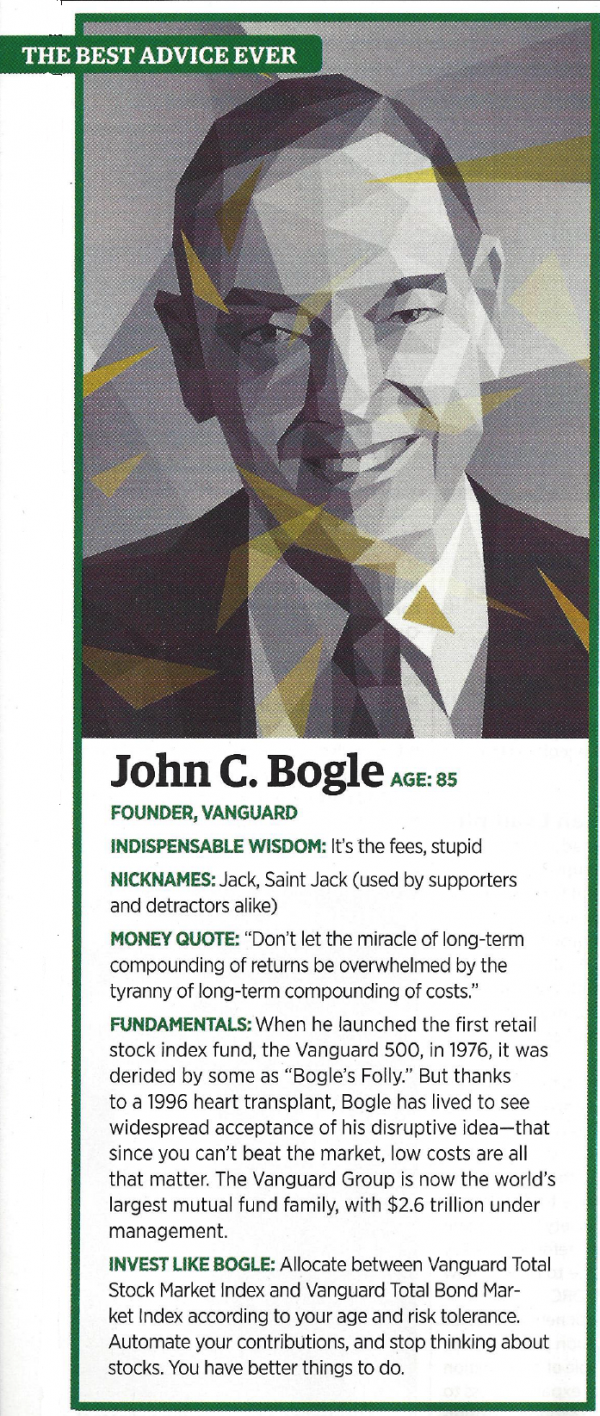

Most notable for those toiling in Chester County was Forbes’ inclusion of Vanguard Group founder and retired CEO, John C. Bogle. Born in Montclair, New Jersey, Bogle, according to Wikipedia, is famous “for his insistence on the superiority of index funds over traditional actively managed mutual funds.”

Mr. Bogle argued throughout his distinguished career that a low-cost index fund performed better over time than an actively managed fund accounting for all the fees actively managed funds charged.

Bogle is regarded as a pioneer and an elder statesmen of the investment world. Named one of the investment industry’s four “Giants of the 20th Century” by Fortune magazine in 1999 and one of the “world’s 100 most powerful and influential people” by Time magazine in 2004, including Bogle’s wisdom and recommendations in Forbes annual investment issue makes sense.

Here are Bogle’s edited recommendation as presented in the June 30th edition of Forbes magazine:

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)