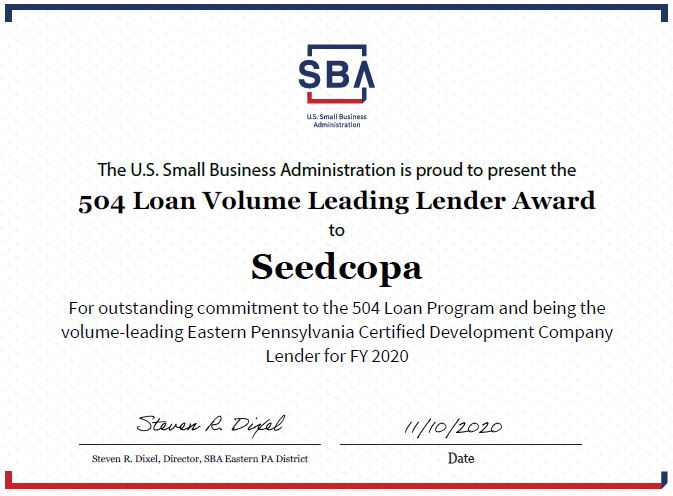

Seedcopa Ranked No. 1 for SBA 504 Lending in Eastern Pennsylvania

Seedcopa, a leading provider of SBA 504 and other below-market loans, has been ranked No. 1 by the U.S. Small Business Administration for attaining the most SBA 504 loans for small businesses in Eastern Pennsylvania. Over $30 million in total projects was financed in Chester County, where Seedcopa is an affiliate of the Chester County Economic Development Council.

Advancing its commitment to helping small- to mid-sized businesses thrive, Seedcopa provided 27 SBA 504 loans totaling $24,358,000 in fiscal year 2020, with projects totaling more than $65 million across Eastern Pennsylvania. This is in addition to work with the Paycheck Protection Program, where Seedcopa assisted with 577 loans totaling $58,175,967.

Over the past 20 years, Seedcopa has been the top SBA 504 lender numerous times, with this year’s loans spanning nine counties in Pennsylvania, including Berks, Chester, Cumberland, Delaware, Lackawanna, Lancaster, Lehigh, Montgomery, and Philadelphia. Seedcopa is a statewide certified development company with ability to cover all counties in Pennsylvania.

“Ranking No. 1 in a service area that spans about half of Pennsylvania is indeed a great honor for Seedcopa and the bank partners we work with,” said Sherwood Robbins, Managing Director of Seedcopa. “We want to thank the many banks that helped us make sure businesses could benefit from the lowest SBA 504 interest rates in history during these difficult times.”

“It’s great to have the opportunity to recognize the accomplishments of SBA Certified Development Companies like Seedcopa,” said Steve Dixel, U.S. Small Business Administration Eastern Pennsylvania District Director. “CDCs like Seedcopa provide capital for small businesses to engage in job creation and community development through the SBA’s 504 loan program.”

Seedcopa helps businesses attain the financing they need through SBA 504 loan projects to purchase, construct, renovate, or expand on new or existing land, as well as to purchase machinery and equipment. SBA 504 is the Small Business Administration’s fixed-rate loan program for small- to mid-sized business owners, and such loans often act as a complement to conventional, commercial loans that Seedcopa facilitates through local banks and credit unions. A typical SBA 504 loan structure requires a contribution from the business owner of only 10 percent. A third-party lender, like a bank or credit union, contributes 50 percent of the project cost. The SBA-backed portion of the loan is 40 percent.

“The 504 program is a powerful economic development loan program, made even more powerful by interest rates at an all-time low – under three percent and fixed for the life of a 25-year loan,” said Gary Smith, President and CEO of the Chester County Economic Development Council. “The affiliation of CCEDC and Seedcopa over the years has offered programs that help these businesses start and scale a business, from drafting a business plan to exporting products or services overseas.”

Click here for a complete listing of Seedcopa’s suite of loan programs and success stories.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)