Vanguard’s Success is Cutting Deep into Wall Street’s Profits

While Washington’s attempts to find a way to reform the big Wall Street banks have so far amounted to basically nothing, the Vanguard Group with its plethora of successful index funds has quietly managed to do exactly that. The company now removes close to $20 billion every year in revenue from the traditional home of the financial service industry, and instead transfers much of that directly into investor’s pockets.

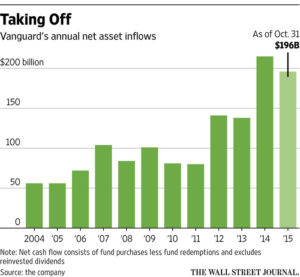

As the reports for this year show, a record $365 billion in net cash flows is being led by Vanguard into low-cost and passively managed index funds and exchange-traded funds. At the same time, Wall Street’s best customers, active mutual funds, have suffered outflows of around $147 billion. The combination comes out to an overall shift of just over half a trillion of dollars, the biggest swing between active and passive funds ever recorded in a single year.

An amazing $185 billion of this represents Vanguard’s take, ensuring that by the end of this year Vanguard will have brought in more money under management for a single year than any asset manager ever has before. This does not look good for Wall Street, as the rise of passively managed funds and in particular Vanguard’s, is hitting the big banks at a time when they are under intense pressure to boost their profits.

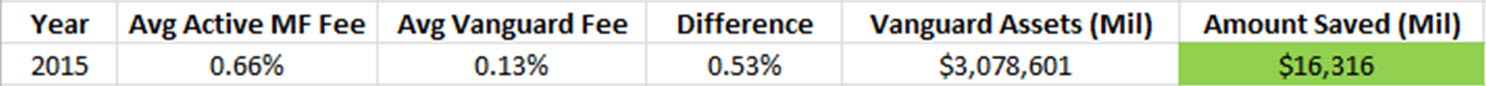

Money has been slowly moving from traditional brokerage accounts into Vanguard’s careful care over the last three decades, resulting in an astonishing $3.1 trillion in assets under management for the index-fund house today. This effectively means that just for this year, Vanguard will earn through its much lower fees structure, over $16 billion which would normally have gone to the big name banks on Wall Street.

$16 billion might only represent a small dent to an industry that generates close to $200 billion annually from both global trading and asset management revenues. However, that ‘small dent’ increases, when it also includes the over $3 billion in additional ‘hidden fees’ charged by active managers from constantly tweaking their portfolios as they try to boost their performance.

More importantly, this dent that is currently totaling close to $20 billion is only expected to increase in the future, as Vanguard has been growing nearly exponentially. It has taken the passive fund giant a little over 30 years to achieve $1 trillion in assets, another 8 years for its second trillion, and now only three years to get to $3 trillion. If this rate of growth continues, Vanguard will most likely be removing a staggering $40 billion in revenue each year from Wall Street by 2020.

In addition to the direct effect Vanguard is having on the financial industry, there is also the so-called ‘Vanguard Effect’ that is causing other funds to drop their fees in order to compete with the significantly lower fees that Vanguard charges, in an attempt to lure some of the cash inflows their way.

The real key to this is how Vanguard manages to make its own profit while only charging low fees. Vanguard’s ability to achieve extremely low costs is ultimately due to the way the founder, John Bogle, formed the company back in 1975. Under his guidance, the company was set up with a “mutual ownership structure.” So while Vanguard does make a profit, that profit does not all go to its shareholders, instead most of the money goes back to its investors through its lower fees, a format that is giving the company its edge.

While this may seem like a dream come true there could be a catch moving forward. At present only around 30 percent of the $16 trillion in total investor assets is held in passive funds with the remaining 70 percent still in active products. If the current trend towards passive investment continues, then it should create opportunities for active managers as more money will be following the ‘herd’. This will create market inefficiencies which active managers can exploit to generate higher returns, which will then see more money flow back in their direction.

Despite this, the combination of Vanguard’s results and its lower fees has made sure that its rise has been felt significantly by Wall Street, leading to an overall reduction in fees across the industry. The company has also managed, with its investor focused principles, to push through more reform on Wall Street than all the current debate and political rhetoric combined.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)