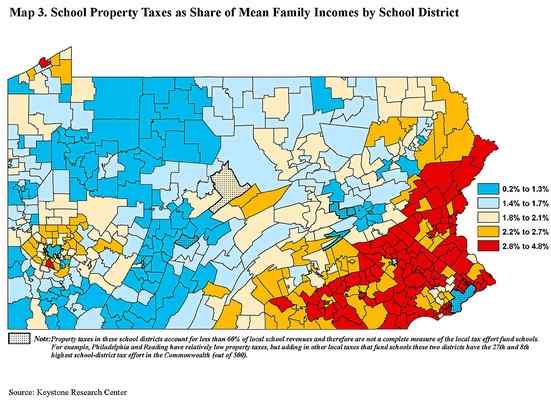

Here Are Five Plans to Cut Property Taxes Being Considered Right Now by State Legislators

Five proposals to cut or eliminate property taxes were presented last Thursday to the state legislature, writes Ford Turner for The Allentown Morning Call.

Plan 1 reduces school property taxes by $8.62 billion. It increases the state’s personal income tax from 3.07 percent to 4.07 percent, increases the sales tax by one percent, and requires school districts levy a local earned income tax of at least one percent.

Plan 2 reduces taxes by $6.4 billion, $4 billion in general property tax relief, $1.5 billion in millage relief, renter relief, expansion of the rent rebate program, and $400 million reduction in “cost driver” school spending.

Plan 3 offers rebates of up to $2,340 to “homestead property” owners, generally owner-occupied homes.

Plan 4 offers rebates of up to $5,000 to homestead properties.

Plan 5 eliminates all school property taxes for homestead properties. The personal income tax would increase from 3.07 to 4.82 percent and the sales tax would increase by one percentage point.

“People are experiencing things in their lives, that they need this school property tax relief sooner rather than later,” said State Sen. Judy Schwank, a member of the work group that looked at possible reforms.

Read more about the proposals in The Allentown Morning Call here.

[uam_ad id=”80503″]

.

[uam_ad id=”80502″]

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)