Vanguard on Track to Smash Record for Cash Inflows in 2015

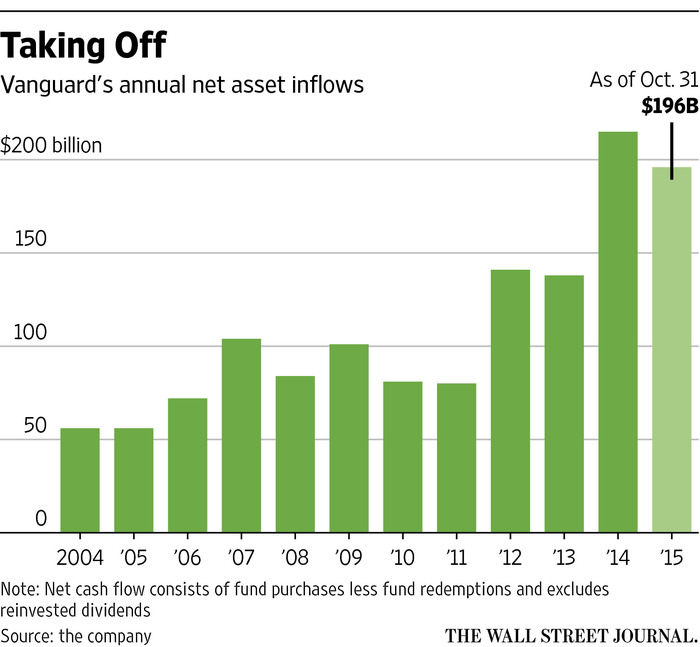

Malvern based Vanguard is still reaping the benefits from its strategy of being the largest provider of index-tracking mutual fund products by taking in $196 billion of investors funds for the ten month period to the end of October.

This is $23 billion more than for the same 10 month period last year and puts Vanguard on track to smash its 2014 record of $216 billion for the year. This success also shows that investors are continuing their recent trend of moving away from actively managed funds in favor of more passively managed funds such as ones that follow indexes and other benchmark.

“It’s a pretty significant increase. They do need to keep up a pretty good pace and they’ll surpass last year,” said Michael Rawson, an analyst at Morningstar. “Passive investing has continued to really beat active. The spread has continued to widen out.”

One of the main reasons that many investors are choosing tracking funds is that the costs are much lower with the fee per $100 for a Vanguard index-tracking fund at around $0.18 versus an average fee of $1.23 per $100 for an active fund that relies on stock and bond pickers according to research by Morningstar.

In total, investors have moved $135 billion away from actively managed U.S. equity funds and taken out $20.6 billion from active bond funds over the same ten month period. This is mostly due to poor performance from active funds and investors becoming increasing restless over the high fees charged for unimpressive results.

With $3.4 trillion under management, Vanguard has been gradually eclipsing its nearest rivals over the last decade, achieving new records for cash inflows and is now the top fund manager for net inflows year to date. This was evidenced earlier this year when Vanguard’s Total Bond Market Index Fund knocked Pimco’s Total Return Fund off the top spot as the world’s largest bond fund, a title it had held for over twenty years.

Chris McIsaac, Managing Director at Vanguard, points to the growing popularity of index investing, the adoption of index funds within 401(k) retirement plans, and a distribution model that involves working directly with investors and financial advisers.

“Flows have been dominated over the last five years by index strategies said McIsaac. “ That’s been the prevailing narrative at Vanguard and I think for the industry.”

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)