Kim Brumbaugh: We Made It Through! Now What?

By Kim Brumbaugh, Founder & CEO of Brumbaugh Wealth Management

We have come a long way since the financial crisis of 2007 and 2008. As we all remember, speculation and falling home prices triggered a chain of events that led to the deepest recession in decades.a

We have come a long way since the financial crisis of 2007 and 2008. As we all remember, speculation and falling home prices triggered a chain of events that led to the deepest recession in decades.a

Since then, contrary to an army of pessimists and doomsayers, world economies and investment markets have been returning to normal. Confidence and liquidity have slowly returned as unemployment rates have improved. Global equity prices have surged.

As the economic recovery continued, at least one thing was not quite normal. Markets had become remarkably calm. History tells us that a periodic 10% decline in equity prices is common.

Over the last 100+ years, a 10% correction has occurred about once per year. As of mid-2015, such a decline had not occurred in almost four years.

As the third quarter began, the Fed openly discussed raising interest rates for the first time since 2006. The Chinese economy, long a driver of economic expansion, began to cool.Against this backdrop, equity markets gave up modest gains and headed south.

While the year-to-date declines are still modest, from peak-to-trough, most equity indices finally experienced a 10% correction. Of course, there has been much said in the media about what this short-term movement means for now and what it portends for the future.

Respectfully, we think they are looking at the wrong thing.

A wise investor once compared short-term market movements to a person walking a dog. He said, “Imagine an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum.

At any one moment, there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the observers, big and small, seem to have their eye on the dog, not the owner.”

That distinction is a key component to our method of financial planning.

Domestic Equities

Domestic equities dealt with a number of headwinds in the third quarter. In addition to the China and interest rate concerns, the continuing decline in commodity prices were on the minds of investors. The S&P GSCI Spot Crude Index fell another 24.2% for the quarter.

As the booming shale fields of Texas and North Dakota cooled, people wondered if the American energy renaissance would continue. If not, what affect would it have on the multitude of industries supplying transportation and services to the industry?

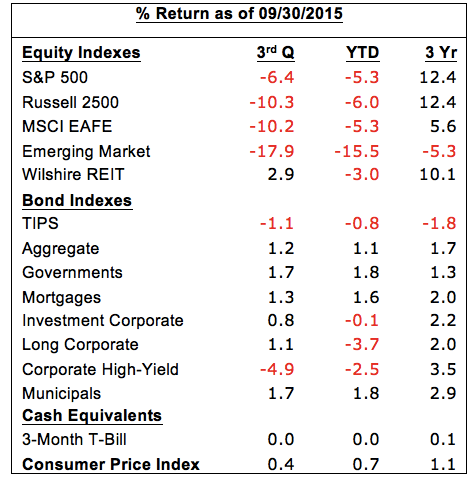

The S&P 500 dropped 6.4% for the quarter. Year-to-date, the index is down 5.3%. The Russell 2500, a gauge of smaller domestic stocks, fell 10.3% for the quarter. For the year, the index is down 6.0%. It should be noted that falling energy prices do have a bright side. Falling prices put money back into the pockets of consumers, thus potentially stimulating other parts of the economy.

International Equities

While some of the issues with Greece and Ukraine settled down, investors found other things to worry about. Moving from the geo-political to the economy, some investors sold. The MSCI EAFE index fell 10.2% for the quarter.

Like the domestic markets, this represented giving back the gains of earlier in the year. So, even with the bad quarter, the index is down only 5.3% for the year. Emerging markets, which are often tied to commodity-based economies, were hit the hardest. The MSCI Emerging Markets Index fell 17.9% and is down 15.5% year-to-date.

Fixed-Income

Bond prices bumped along weighing the positive and negative effects of falling commodity prices and a Fed potentially ready to finally begin raising rates. In the end, it was a stand-off. The Barclays Aggregate, a broad measure of the domestic bond market, managed to eke out a 1.2% gain for the year. That brings the calendar year performance up to 1.1%.

Investors should bear in mind that rising interest rates, when they do finally come, are not necessarily a bad thing. Years of higher coupons and reinvestment are likely to overcome any price erosion over time.

Investors are always confronting uncertainty. That is the nature of investing. What makes this even more difficult is that the uncertainties are ever-changing. Over the past few years, we have grappled with an impaired economy, struggling to regain its strength.

This recovery was sustained with the help of government intervention and artificially low interest rates. We made it through.

Over the next several years, the challenges will be different. Now that the crisis has passed, we must eventually adjust to the withdrawal of fiscal stimulus. This will likely mean that, somewhere along the way, interest rates will return to more normal levels.

This will not necessarily be a bad thing. It could mean that the economy is finally strong enough to stand on its own. There will be fits and starts along the way as we make the transition. We will make it through those as well.

Our analogy about the man walking the dog might seem simple and quaint. The underlying principles are profound, if properly applied. First, observe the entire situation and separate the few important factors from the overwhelming noise.

Secondly, use the information available to quantify and monitor possible outcomes. Lastly, and perhaps most importantly, during times of great distraction, remember that there is a person at the core of your analysis.

It is possible that the current return of volatility in the markets will continue. We are ready for that. Our principles will get us through whatever comes. After all, this is just a return to the normal state of the markets.

Fortunately, there are things we can do. We listen carefully to your goals. Then, we apply our unique discipline and intelligent allocation toward helping you accomplish them. This is our approach in all market environments.

_________

Kimberly Brumbaugh is a registered representative of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies. In MI., Securities and investment advisory services offered through Lincoln Financial Advisors Corp. a broker/dealer, registered Investment advisor. Brumbaugh Wealth Management is not an affiliate of Lincoln Financial Advisors Corp.

Kimberly Brumbaugh is a registered representative of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies. In MI., Securities and investment advisory services offered through Lincoln Financial Advisors Corp. a broker/dealer, registered Investment advisor. Brumbaugh Wealth Management is not an affiliate of Lincoln Financial Advisors Corp.

______

The content of this investment review was provided to you by Lincoln Financial Network for its representatives and their clients. Lincoln Financial Network is the marketing name for Lincoln Financial Advisors Corp. and Lincoln Financial Securities Corporation.

Source of data – – Morningstar, U.S. Department of Commerce, Wall Street Journal, St. Louis Federal Reserve, Bloomberg, The Federal Reserve. The performance of an unmanaged index is not indicative of the performance of any particular investment. It is not possible to invest directly in any index. Past performance is no guarantee of future results. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. 3 year performance data is annualized. Bonds have fixed principal value and yield if held to maturity and the issuer does not enter into default. Bonds have inflation, credit, and interest rate risk. Treasury Inflation Protected Securities (TIPS) have principal values that grow with inflation if held to maturity. High-yield bonds (lower rated or junk bonds) experience higher volatility and increased credit risk when compared to other fixed-income investments. REITs are subject to real estate risks associated with operating and leasing properties. Additional risks include changes in economic conditions, interest rates, property values, and supply and demand, as well as possible environmental liabilities, zoning issues and natural disasters. Stocks can have fluctuating principal and returns based on changing market conditions. The prices of small company stocks generally are more volatile than those of large company stocks. International investing involves special risks not found in domestic investing, including political and social differences and currency fluctuations due to economic decisions. Investing in emerging markets can be riskier than investing in well-established foreign markets.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)