Vanguard: ‘US Labor Tight (Enough) For Lift Off’

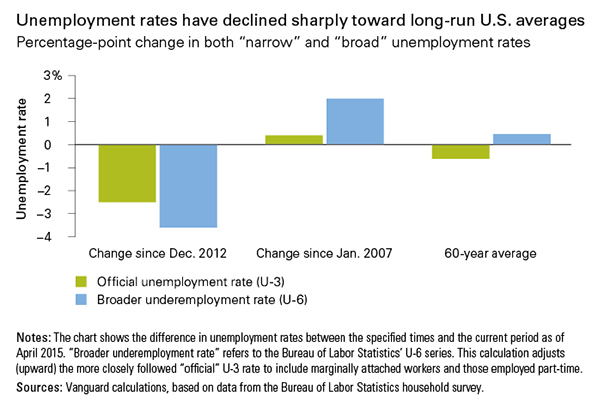

The U.S. job market is actually doing a lot better than many news reports would lead people to believe, according to a Vanguard report. Although not yet back to its pre-recession lows, at 5.5% it is already well below the 60 year average of 6.0%. The improvement has been staggering over the last three years and with the job market becoming ever tighter, the Federal Reserve will factor in this key economic indicator when determining when, and if, to raise the benchmark interest rate.

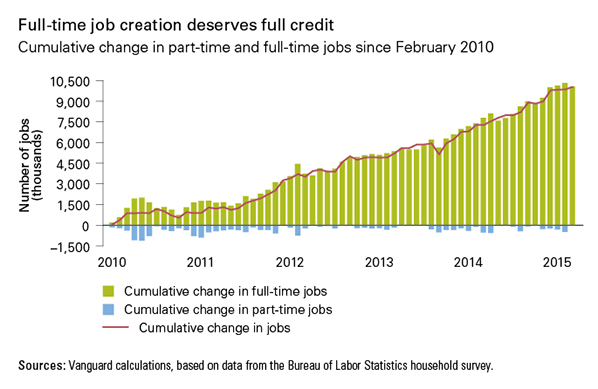

The question underlying this issue is whether the 5.5% figure is actually truly representative of the state of the job market as a whole. Some analysts contend that the figure is artificially inflated due to an increase in lower quality full-time jobs and more part-time jobs being created, to replace the 11 million full-time jobs that were lost between 2008 and 2010 during the recession.

The most noticeable change in the market is that while more jobs are being created, the majority of them are at polar opposites. There are a greater number of lower and higher paid positions being created while mid-level job position creation is lagging behind. This could be a result of increased globalization and the higher premium that employers are placing on select specialized skill sets.

It is clear from Vanguards analysis of the Bureau of Labors Statistics Household Survey, that part-time job creation is increasing, but it is doing so broadly in line with the creation of new full-time positions. This flies in the face of many political pundits who say Obama is massaging the growth in employment for political gain. If fact, the job market is recovering and if it continues at its current pace could be stronger than it was before the 2008 recession began.

The only issue holding back an increase in interest rates is that wage growth is not in line with the increasing level of employment. Additionally, with inflation still below the Federal Reserves target of 2% and the current global economic uncertainty, there is still a chance that it will delay any increase until 2016. But Vanguard is predicting that interest rates with a rise at some point before the end of this year.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)