Chesco Banks Lead The Way In New Innovations

The power to do almost anything you used to have to step foot in a bank for is now at your fingertips every morning, afternoon and evening. And some of the most innovative new features come to you from Chester County banks.

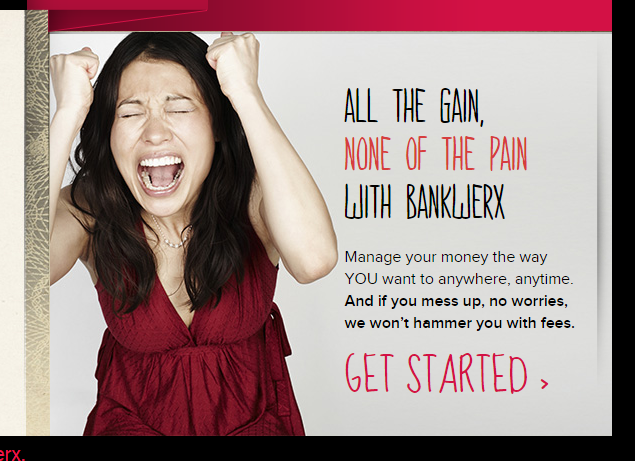

Conestoga Bank in Chester Springs has pioneered a new branch concept featuring video teller machines called Bankwerx.

“The remote teller can conduct virtually any transaction that an in-branch teller can and allows the bank to have longer hours and repurpose in-branch personnel into sales roles,” a Philadelphia Business Journal feature explained.

One of its first deployments was at the Gateway Shopping Center in Wayne.

“I think you could end up speaking to a video teller in the same type of back office on your phone or tablet rather than going to a branch or ATM,” CEO Rick Elko said in the article. “The only thing you couldn’t do is get cash. And most of what the video tellers do is now deposit oriented, but I think lending is coming as well.”

Meanwhile, another innovation is PNC Bank’s tellerless solution center in its Malvern branch at Uptown Worthington, featuring iPads and smart ATMs, video conferencing and touchscreen product demos.

“It doesn’t mean there aren’t people in the branch,” Executive Vice President and Head of Branch Banking Todd Barnhart said. “They are just doing different things. Customers are not coming for transactions. Those who are coming have broader issues. And the branch is still the one place customers can go if they want to speak to someone about their money in the digital world.”

Other innovations featured in the article included money management apps like impulse savings notifications, automated transfers to savings and automated rounding up of a purchase amount for transfers to investment accounts, as well as biometric scanning of your face and voice for identity verification.

Bala Cynwyd-based automated lending software Invantage Suite by Integress is the pioneer in that realm.

“Now customers can get home equity loans approved without going to a branch,” Royal Bank America CEO Kevin Tylus said. “People are not doing their banking as much during traditional hours. So now they can apply for a loan at 10 p.m. if they want.”

Read much more about the coming banking innovations in the Philadelphia Business Journal here.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)