Benchmark FCU Survey Shows Local High-Schoolers Vastly Underestimate Cost of Living Expenses

A survey of local high school students shows their primary money concern if they go to college is living expenses, yet the majority vastly underestimate those expenses by about 50 percent.

A survey of local high school students shows their primary money concern if they go to college is living expenses, yet the majority vastly underestimate those expenses by about 50 percent.

The survey was conducted by Benchmark Federal Credit Union (the only federal credit union to exclusively serve Chester County) during financial literacy workshops for 69 juniors and seniors at Downingtown East High School.

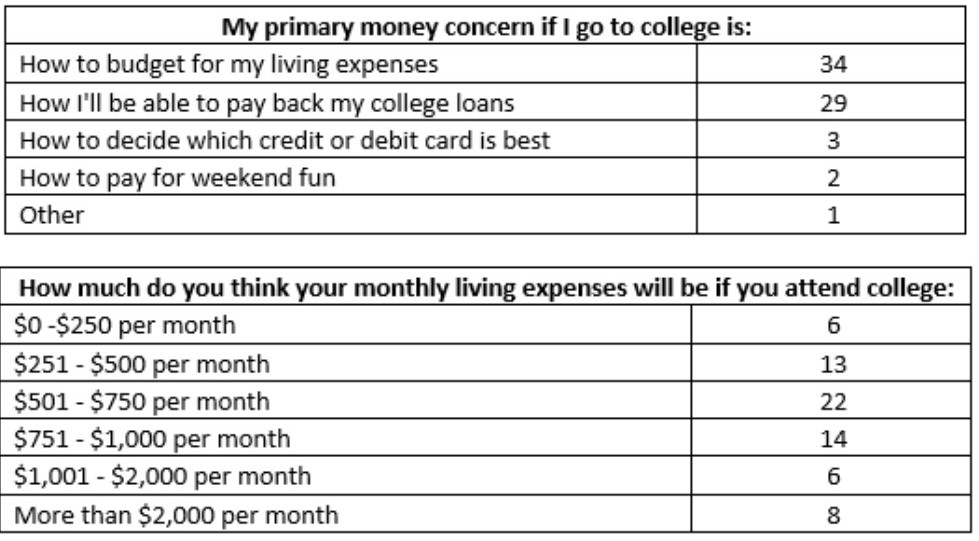

About half of the students surveyed (34) said their primary money concern if they go to college is how to budget for living expenses. Slightly less (29) said their primary money concern is how they would pay back college loans. The small remainder listed credit or debit card debt, weekend fun, and “other” as money concerns.

While living expenses is the top concern in the survey, 80 percent of the students surveyed (55 of 69 students) underestimated those living expenses, saying their living expenses would be $1,000 or less per month. According to the College Board, college living expenses average more than twice that – $2,081 per month – on a moderate budget for 2018-2019.

In the Benchmark Federal Credit Union survey, only eight students estimated more than $2,000 a month for their living expenses. Most (22 students) estimated $501-$750 per month, followed by $751-$1000 per month and $251-$500 per month.

“This dramatic disparity is something Benchmark Federal Credit Union has long observed while supporting our members as their children transition from living at home to living semi-independently for the first time at college,” said David LaSala, Benchmark Federal Credit Union President and CEO. “Many children are unprepared for the expenses facing them and how to budget for those expenses while living responsibly.”

To aid in increasing financial literacy, Benchmark Federal Credit Union provides a free, award-winning financial literacy curriculum in more than 59 public, private, and parochial schools across Chester County that aligns with state curriculum requirements for personal finance education. Students are exposed to real-life scenarios where they learn to pay bills, balance a budget, and manage unexpected expenses such as parking tickets, interest charges, and overdraft fees. The educational program also introduces students to auto loans, bank statements, entertainment costs, savings, and more.

Benchmark Federal Credit Union also offers the following five tips to students heading off to college:

- Set monthly financial goals. Establish what end result you want to reach, and make choices based on your top priorities.

- Analyze where your money goes. Track your actual spending each month using a budget worksheet or spreadsheet.

- Build a budget. After you’ve tracked actual spending, try to keep your expenses in line with your goals.

- Choose a credit card carefully. Shop around for the best offers available from local financial institutions you know and trust. SafeBee.com notes that credit unions often offer better value.

- Consolidate debt. If a new college student does rack up credit card debt, consolidation is key. That means taking all of your high-interest credit card debt and transferring it to a new credit card with a lower interest rate.

Below are the complete results of the Benchmark Credit Union survey:

.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)