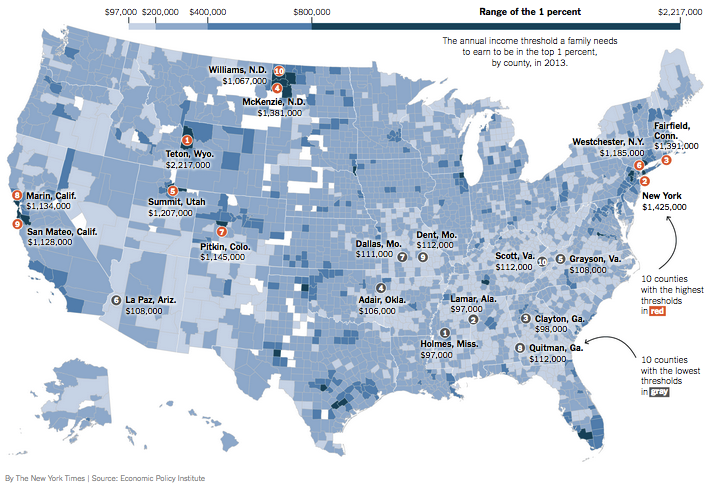

Are You in Chester County’s Top One Percent? Find Out Here

To be in the top one percent of incomes nationally, families need to take in a minimum of $389,436. The average income of America’s one-percenters is $1,153,293, according to a recent study by the Economic Policy Institute.

Yet when incomes are measured state by state, the study shows wildly diverging fortunes for one-percenters. Suburban Philadelphia, as one would imagine, is doing quite well.

Recent studies have indicated that wealth is becoming more concentrated in certain areas, even counties.

Which means that an additional tax on America’s one percent would be all but a regional tax.

In Chester County, families need to take in a minimum of $740,248 to be among the county’s one percent. That’s almost twice the national average, and it ranks Chester County 41st in the nation.

The average income of Chester County’s top one percent is more than $1.7 million, and the average income of the bottom 99 percent is roughly $81,000.

In neighboring Montgomery County, families need to take in a minimum of $751,748 to be among the county’s one percent. Montgomery County ranks 38th in the nation.

The average income of Montgomery County’s top one percent is more than $2.0 million, and the average income of the bottom 99 percent is roughly $75,000.

In Delaware County, families need to take in a minimum of $555,878 to be among the county’s one percent. Delaware County ranks 108th in the nation.

The average income of Delaware County’s top one percent is more than $1.3 million, and the average income of the bottom 99 percent is roughly $60,000.

The data reveals that the one percent is no longer the very top layer of the national economy, but a much deeper slice of residents in high-income, high-cost states.

The shift has important policy and cultural implications. Calls to tax the one percent nationally are really calls to tax the top five or 10 percent in the richest states — while missing the top one percent in many Western and Southern states.

“A tax on the one percent is increasingly a regional tax,” said Mark Price, a labor economist at the Keystone Research Center. “On average, more folks will be touched by higher rates in New York than, say, West Virginia.”

Click here to read more about America’s one percent from the New York Times.

Click here to read more of the data on America’s one percent from the Economic Policy Institute.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)