Chester County Housing Market Trends

By Chris LaGarde & Caleb Knecht of Keller Williams Real Estate

Cutthroat and competitive.

Those are the words for this approaching the spring housing market, at least for buyers.

Buyers, as we will touch on, are entering a 3rd year of a very competitive market where every little detail of their offer will be scrutinized by Sellers.

For seller’s, it’s likely going to be a breeze, depending on your local market.

Let’s take a look at the details.

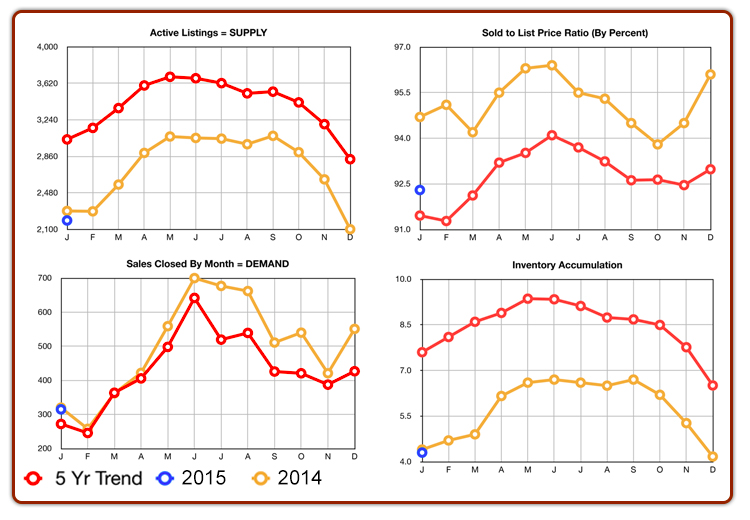

Demand: Nothing shocking here to report as the number of homes settled in January followed suit with last year and is not much different than the five-year trend. However it is elevated above the five-year trend, which is expected at this point.

Supply & Inventory Accumulation: If there was an area to be concerned about, it would be these stats. The number of homes available for sale right now are even lower than last year. If you are looking to sell your home and see values of homes increase, this is a decent sign. Lack of inventory drives prices upward. If you are a buyer, it looks like it’s going to be a very cutthroat and competitive market again this year. Last year, roughly 75% of the offers our team put in for buyers were multiple offer situations. We can only assume it’s going to be similar this year.

Sold to List Ratio: This one was a bit of an anomaly is how much seller’s received for their homes compared to asking price. When we looked further into it, it turns out that homes selling above $1 million had a list to sale ratio of 86%. So, if you want to buy a home above $1M, now is the time to do it! It looks like you can get some serious steals in the luxury market. In fact, activity in the luxury market was up over 100% when compared to last year, which is what we mentioned last month. When you look at homes sold under $1M, the LTSP ratio was closer to 94.5%.

Interest Rates: Interest rates continue to be very low. In many cases as low as 3.5% for a 30 year, conventional loan. The big news is that FHA loans have cut their PMI by almost half. So what that means is that if you purchased a home using an FHA loan up until the end of January of this year, you probably were paying around $150 – $200 per month in PMI, possibly higher. Now it would be almost half that. So, if you purchase a home in the last 2 years using an FHA loan or you had a conventional loan at 4.5% or higher, you should strongly consider refinancing! It could save you as much as $100 per month or more.

Conclusion: It feels like Deja-vu as the market conditions are almost exactly the same except prices have improved and luxury homes are moving. This means that it’s going to be a great market to sell in, assuming you are priced right and your realtor takes good photos. It’s very likely your home will sell quickly, depending on your local market. As buyers, it’s going to be tough but if you are prepared to make quick decisions, you can get a home at a great price, with an amazing interest.

Connect With Your Community

Subscribe to stay informed!

"*" indicates required fields

![95000-1023_ACJ_BannerAd[1]](https://vista.today/wp-content/uploads/2023/03/95000-1023_ACJ_BannerAd1.jpg)